how to pay indiana state estimated taxes online

Take the renters deduction. Take the renters deduction.

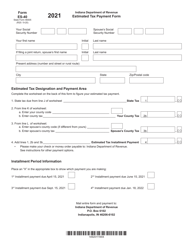

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Individual Estimated IT-40ES Payment.

. Find Indiana tax forms. Indiana Income Taxes. Claim a gambling loss on my Indiana return.

Have more time to file my taxes and I think I will owe the Department. 124 Main rather than 124 Main Street or Doe rather than John Doe. Failure to pay tax - 10 of the unpaid tax liability or 5 whichever is greater.

One to the IRS and one to your state. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. If you did make estimated tax payments either they were not paid on time or you did not pay enough to.

Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours. How to Pay Indiana State Taxes Step 1. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

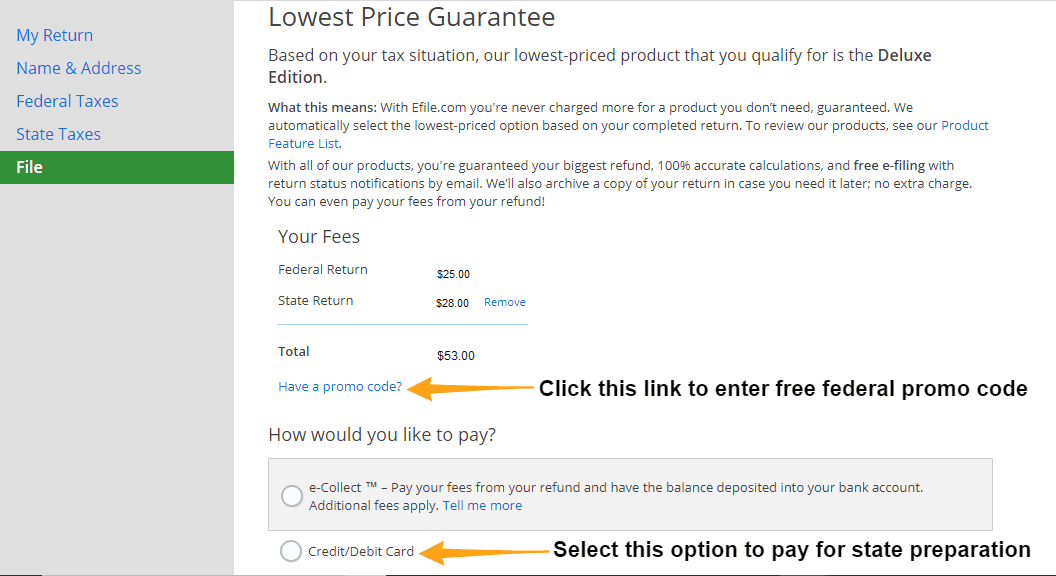

To make payments toward a previous tax year filing please select or link to the Individual Tax Return IT-40 payment option. Some states also require estimated quarterly taxes. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

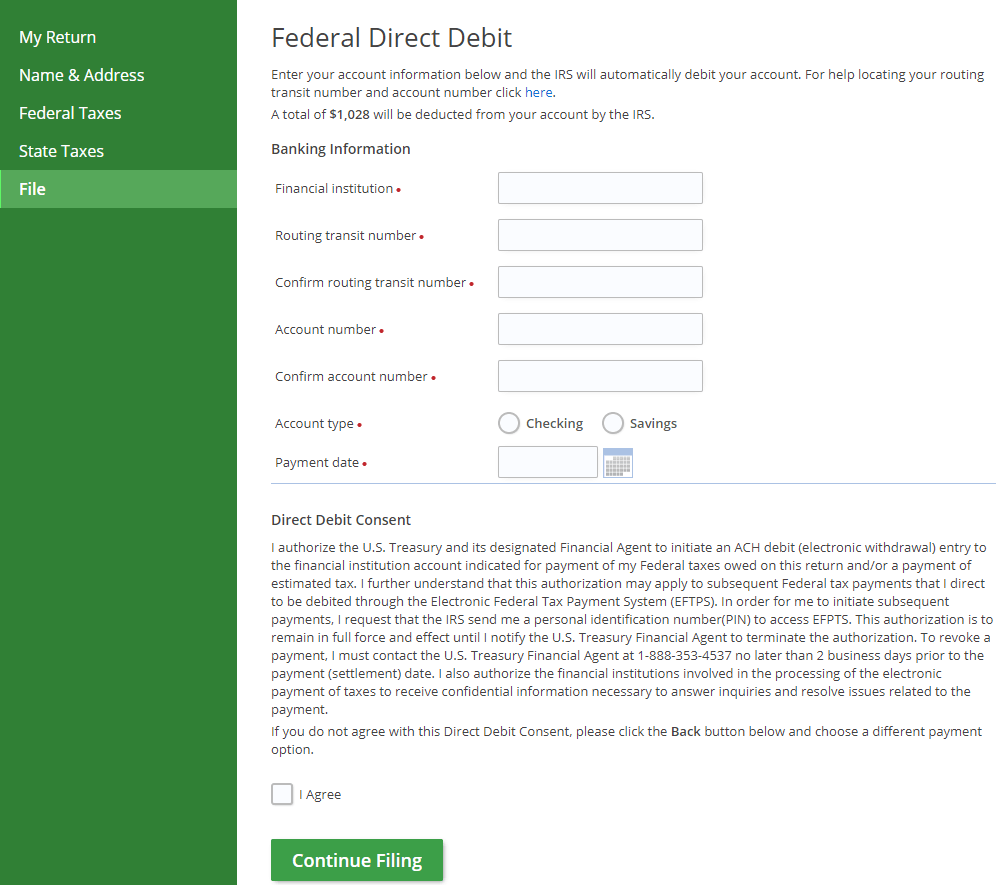

File personal income taxes. To make a payment via INTIME. Return to your Account Summary homepage and select Make a payment again.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. The tax bill is a penalty for not making proper estimated tax payments. Pay directly from your bank account or by credit card for a fee.

You can make an estimated income tax payment with an Individual or Fiduciary Online Services account. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form. Failure to file a tax return.

Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. This penalty is also imposed on payments which are required to be remitted electronically but are not. Make an estimated income tax payment.

Fraudulent intent to evade tax - 100 penalty. Paying online Filling out ES-40. This option is to pay the estimated payments towards the next year tax balance due.

Tom Wolf Governor C. Personal Income Tax Payment. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a. Know when I will receive my tax refund.

Estimated payments can be made by one of the following methods. Pay by telephone using. Pay my tax bill in installments.

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. Once logged-in go to the Summary tab and locate the Make a payment hyperlink in the Account panel. You can also pay.

Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours. For assistance users may contact the Taxpayer Service Section Monday through Friday from 830 am until 430 pm via email at taxhelpmarylandtaxesgov or by phone at 410-260-7980 from central Maryland or 1-800-MDTAXES 1-800-638-2937 from elsewhere. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest.

If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments. Have more time to file my taxes and I think I will owe the Department. View the estimated tax payment due dates to ensure your payment is timely.

Log in Create an account. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. Find Indiana tax forms.

Unlike the federal income tax system rates do not vary based on income level. This means you may need to make two estimated tax payments each quarter. Failure to file a tax return.

Rates do increase however based on geography. We offer extended taxpayer support during peak filing season. Preparation by Department - 20 penalty.

The option to make an estimated payment will appear in the Payment. Access INTIME at intimedoringov. INtax only remains available to file and pay the following tax obligations until July 8 2022.

Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check. If you need to make an estimated tax payment for a partnership see Partnership information. You can pay with credit cards online or over the telephone.

You may qualify to use our fast and friendly INfreefile to file your IT-40 IT-40PNR or IT-40RNR directly through the Internet. Select Payments bills and notices then select Make a payment from the expanded menu. QuickBooks Self-Employed calculates federal estimated quarterly taxes.

In the top right corner click on New to INTIME. Realty Transfer Tax Payment. Wheres My Income Tax Refund.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Property TaxRent Rebate Status. Search by address Search by parcel number.

Pay my tax bill in installments. Want to schedule additional payments. For best search results enter a partial street name and partial owner name ie.

Estimated payments may also be made online through Indianas INTIME website. Pay estimated income Tax. Know when I will receive my tax refund.

Decide on your method of payment. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form.

Proudly founded in 1681 as a place of tolerance and freedom. If you have not yet filed your tax return when you reach the File section you have the option to either have the amount due debited from your bank account or you can select the option to mail a checkOr you can use the link below to pay your state taxes due. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

Claim a gambling loss on my Indiana return. Search for your property. If youre self-employed you need to pay federal estimated quarterly taxes for the income you make.

Indiana State Tax Information Support

Indiana Sales Tax Small Business Guide Truic

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

Where S My State Refund Track Your Refund In Every State Taxact Blog

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Dor Keep An Eye Out For Estimated Tax Payments

2021 State Income Tax Return Prepare Online On Efile Com

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

I Live In Indiana And I Have Worked In Kentucky T

Dor Indiana Extends The Individual Filing And Payment Deadline

Indiana Dept Of Revenue Inrevenue Twitter

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

E File Indiana Taxes Get A Fast Refund E File Com

Is Indiana Tax Friendly Where Hoosier State Ranks Nationally